Maximal Extractable Value (MEV) has long been a hidden tax on DeFi participants. For years, users unknowingly lost value to sophisticated searchers and validators who extracted profits by reordering, including, or excluding transactions within blocks. But the landscape is changing rapidly. MEV rebates are emerging as a transformative force, flipping the script and returning value directly to the users who generate it.

From Hidden Costs to Tangible Rewards

Every swap, trade, or liquidity provision in DeFi can generate MEV, often without user awareness. Traditional models allowed this value to be siphoned off by a select few, fueling frustration and eroding trust. Today’s leading protocols are integrating MEV rebate mechanisms, turning what was once an invisible cost into a visible benefit for end-users.

This shift is not just theoretical. In 2024 alone, MEV Blocker distributed 4,079 ETH in rebates, evidence that real money is flowing back into user wallets instead of being captured by intermediaries. The result? Enhanced fairness, improved retention, and a new era of transparent MEV sharing.

How Leading Protocols Are Implementing MEV Rebates

MEV Blocker, launched by a powerhouse consortium of Ethereum teams, protects users from front-running and sandwich attacks by routing transactions through a private network. The protocol auctions off backrun rights and returns up to 90% of builder rewards as direct rebates to users, a model that has fostered measurable increases in user trust and engagement.

RediSwap takes a different approach: this AMM captures arbitrage opportunities at the application layer and redistributes profits between both traders and liquidity providers. By internalizing MEV flows within its pools, RediSwap achieves better execution outcomes compared to many legacy AMMs, and ensures that those creating value also share in it.

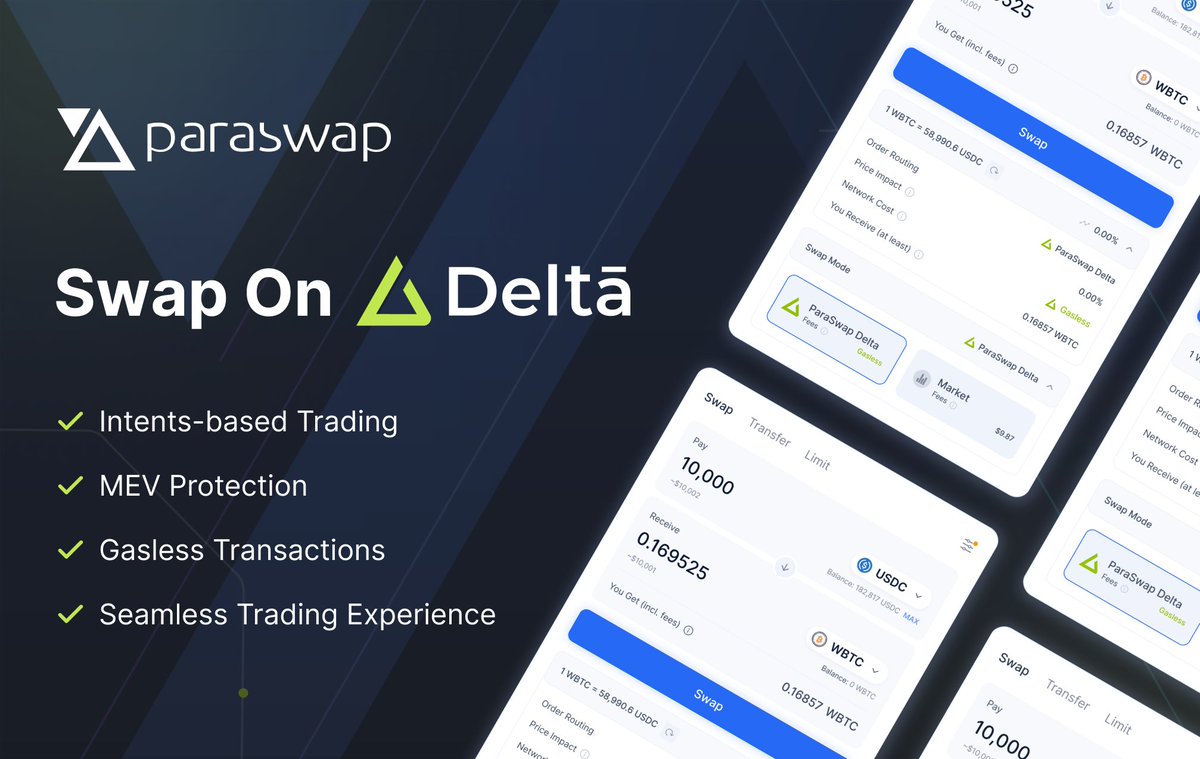

ParaSwap’s Delta Protocol leverages intent-based trading with AI-driven execution auctions. Here, users specify their desired outcomes; competing agents optimize for execution efficiency while minimizing the risk of MEV exploitation. This architecture aligns incentives across all participants and sets new standards for user-centric design in DeFi trading.

Wallchain, meanwhile, pioneers hybrid MEV redistribution by combining user swaps with searcher participation. Instead of leaking value externally, Wallchain channels it back to users through seamless rebates, transforming the narrative from “MEV as tax” to “MEV as dividend. ” For more insights on these evolving mechanisms and their impact on protocol fairness, see this detailed guide.

The Impact on User Experience: Data-Driven Outcomes

The integration of transparent MEV sharing isn’t just a technical upgrade, it’s fundamentally reshaping how users perceive and interact with DeFi protocols:

- User Empowerment: Rebates put real value back in user hands for every transaction executed.

- Ecosystem Alignment: By sharing profits among traders, LPs, developers, and even searchers via open auctions or internalization strategies, friction decreases while collaboration grows.

- Sustainable Growth: Platforms with fair redistribution see higher retention rates as users feel tangibly rewarded for their activity, not just lured by short-term incentives.

This data-driven evolution is not just about mitigating losses; it’s about building sustainable market structures where everyone benefits from transparent MEV value return. As more protocols adopt these models and refine their approaches, expect user experience, and competition for user loyalty, to reach new heights across the DeFi landscape.

Protocol-specific data highlights just how quickly the MEV rebate paradigm is gaining traction. For example, MEV Blocker’s 4,079 ETH payout in 2024 isn’t just a headline figure, it represents thousands of users receiving direct compensation for their on-chain activity. Similarly, RediSwap’s internal analytics show a measurable reduction in slippage and improved trade execution, while ParaSwap’s Delta Protocol reports a significant drop in user complaints related to front-running and sandwich attacks.

Wallchain’s browser extension has also lowered the barrier for everyday users to access MEV rebates. By routing swaps through protected orderflow and integrating with major wallets, Wallchain makes cashback-style rewards as seamless as using any leading DEX aggregator. These real-world implementations underscore that MEV redistribution protocols are no longer experimental, they’re fast becoming table stakes for user-first DeFi platforms.

What’s Next for MEV Rebates in DeFi?

With adoption accelerating, several trends are emerging:

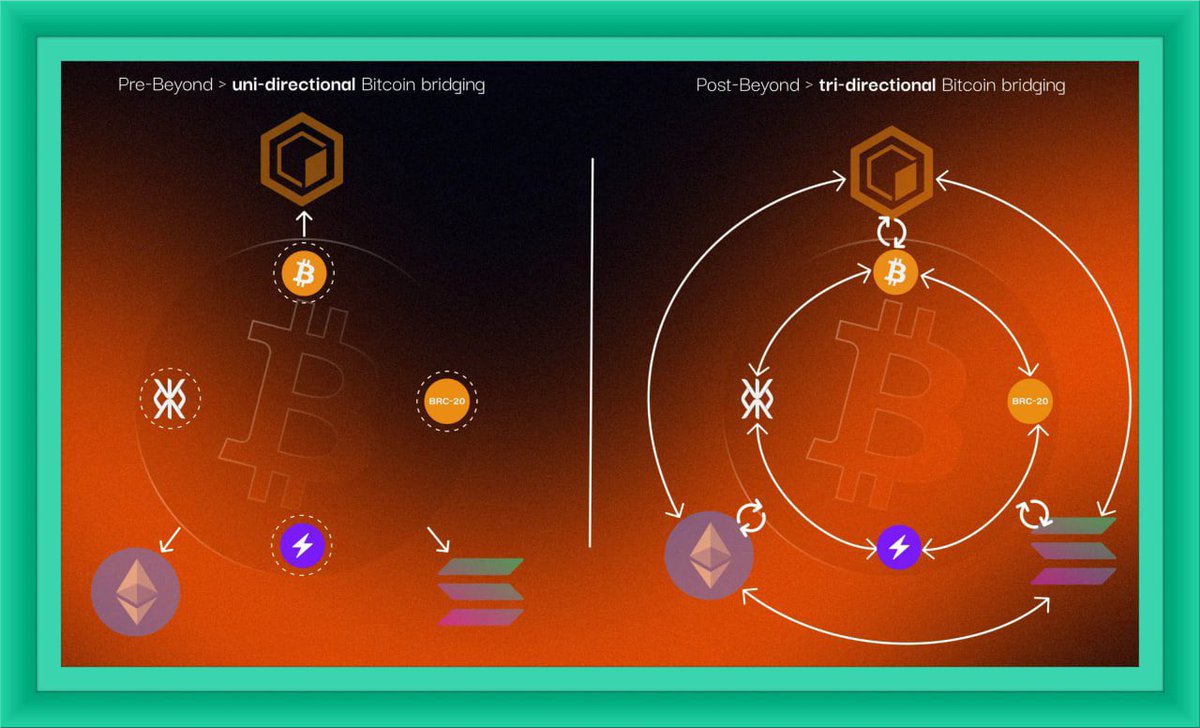

- Cross-Protocol Integration: Expect to see MEV rebate engines embedded directly into wallets, aggregators, and even Layer 2 rollups, making value return frictionless across the entire transaction stack.

- User Customization: Advanced protocols are exploring opt-in models where users can choose between higher rebates or additional protections, tailoring their experience based on risk appetite and trading style.

- Data Transparency: As more platforms compete on fairness metrics, expect dashboards showing live rebate stats, historical distributions, and protocol-level MEV flows, empowering users to make informed choices about where to transact.

Key Benefits of MEV Rebates in DeFi Protocols

-

Cashback-Style Rewards: Platforms like MEV Blocker return up to 90% of builder rewards as rebates, directly rewarding users for their activity and increasing protocol engagement.

-

Improved Trade Execution: RediSwap captures and redistributes MEV at the application level, leading to better execution prices and reduced slippage for traders.

-

Protection from MEV Exploits: ParaSwap’s Delta Protocol uses intent-based trading and auctions to minimize front-running and sandwich attacks, safeguarding user transactions.

-

Ecosystem Alignment: Wallchain enables protocols to internalize and share MEV profits, aligning incentives for users, liquidity providers, and developers.

-

Increased User Retention: Transparent MEV rebates foster trust and loyalty, as users see tangible value returned for their participation, driving higher retention rates across DeFi platforms.

The arms race for user trust is pushing DeFi toward a future where transparent MEV sharing is standard practice. Protocols that ignore this shift risk falling behind as users increasingly demand both performance and fairness from their trading venues.

The bottom line: MEV rebates have moved from theory to practice. They’re already transforming the DeFi user experience by converting hidden costs into tangible rewards. As mechanisms mature and adoption widens, expect the next generation of blockchain applications to treat fair value return not as a perk, but as a baseline expectation for all participants.