Maximal Extractable Value (MEV) has become a defining issue for decentralized finance, fundamentally shaping the user experience and market structure of DeFi protocols. At its core, MEV describes the profit that can be captured by those with power over transaction ordering, typically miners or validators, by reordering, inserting, or excluding transactions within a block. This dynamic has led to widespread concerns around fairness, as regular users often bear the costs of front-running and sandwich attacks while sophisticated actors capture outsized profits. MEV redistribution protocols have emerged as a direct response to these imbalances, promising to realign incentives and drive greater equity in DeFi trading.

Why Traditional MEV Extraction Undermines DeFi Fairness

In traditional DeFi markets, MEV is typically extracted by searchers and validators who exploit their privileged position in the transaction pipeline. This extraction takes many forms, front-running trades on decentralized exchanges, executing sandwich attacks that increase slippage for unsuspecting users, or manipulating oracle updates for profit. The result is a system where value accrues to a select few at the expense of the broader community. As highlighted in recent research from sources like PhD Research in DeFi and Cow. fi, this concentration of value not only increases user costs but also erodes trust in protocol neutrality.

The negative consequences extend beyond individual users. According to studies published by the European Securities and Markets Authority and ACM SIGSAC, unchecked MEV extraction can destabilize consensus mechanisms and create inefficient equilibria, such as discouraging staking or liquidity provision under benign conditions. In essence, when MEV is left unaddressed, it undermines both security and efficiency across the DeFi ecosystem.

Mechanisms Driving Fairer MEV Redistribution

To counteract these risks, innovative protocols are deploying mechanisms that share extracted value more broadly among participants. Below are some of the leading strategies making tangible improvements in DeFi trading fairness:

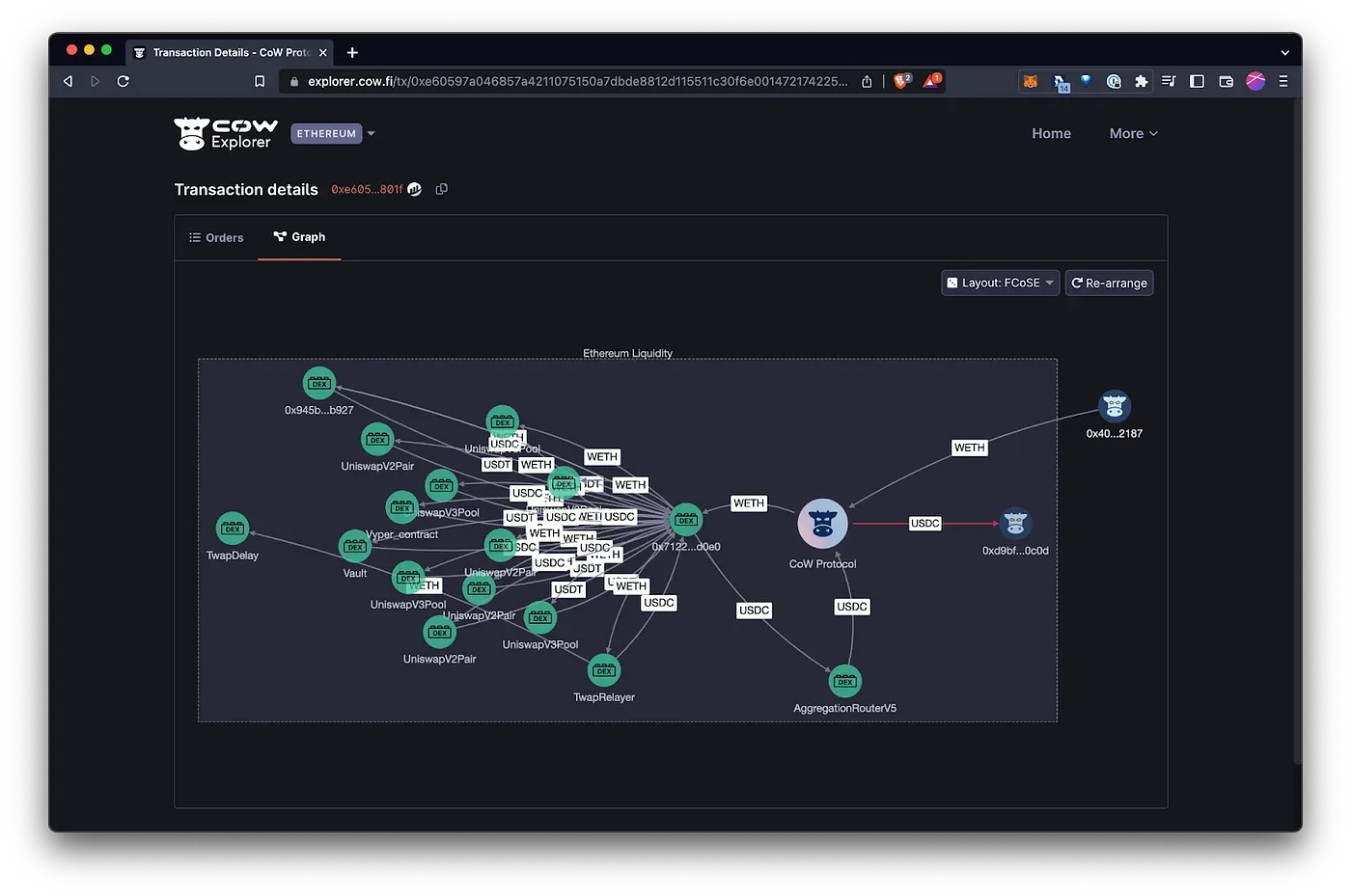

- Order Flow Auctions (OFAs): By allowing searchers to bid for transaction execution rights, with proceeds redistributed to users, OFAs create a competitive marketplace for transaction order flow. Protocols like CoW Protocol and UniswapX have pioneered this approach, ensuring that users receive compensation for their valuable order flow rather than being passive victims of predatory tactics.

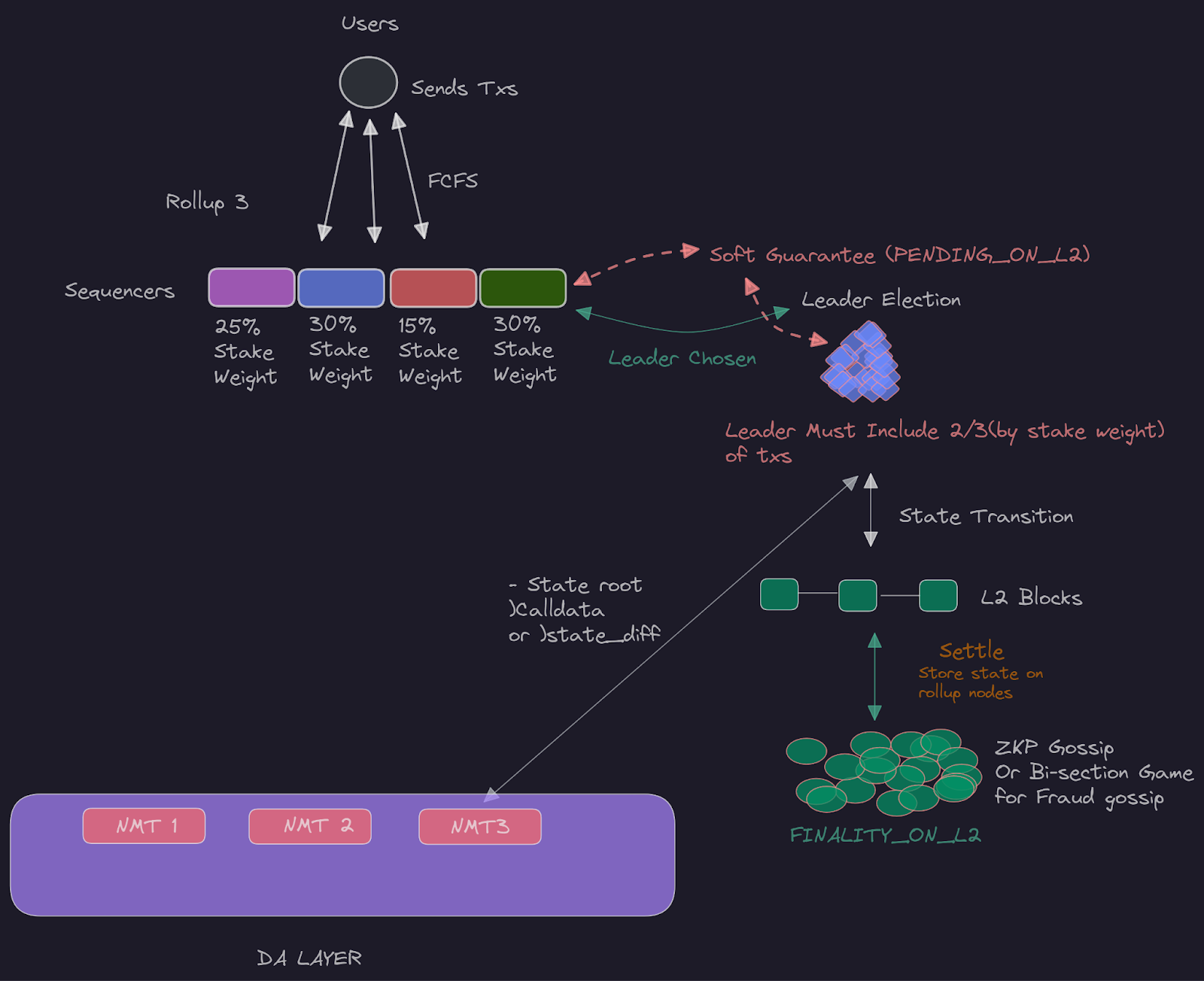

- Fair Sequencing Services (FSS): FSS enforces strict first-in-first-out processing of transactions or other transparent sequencing methods that prevent manipulative reordering by block proposers. Chainlink’s FSS exemplifies this model by increasing transparency and reducing opportunities for extraction-based attacks.

- MEV Rebates: Some solutions directly return a portion of MEV rewards to end-users. For example, MEV Blocker refunds up to 90% of builder rewards back to traders, a radical shift from previous models where nearly all value was siphoned off by intermediaries.

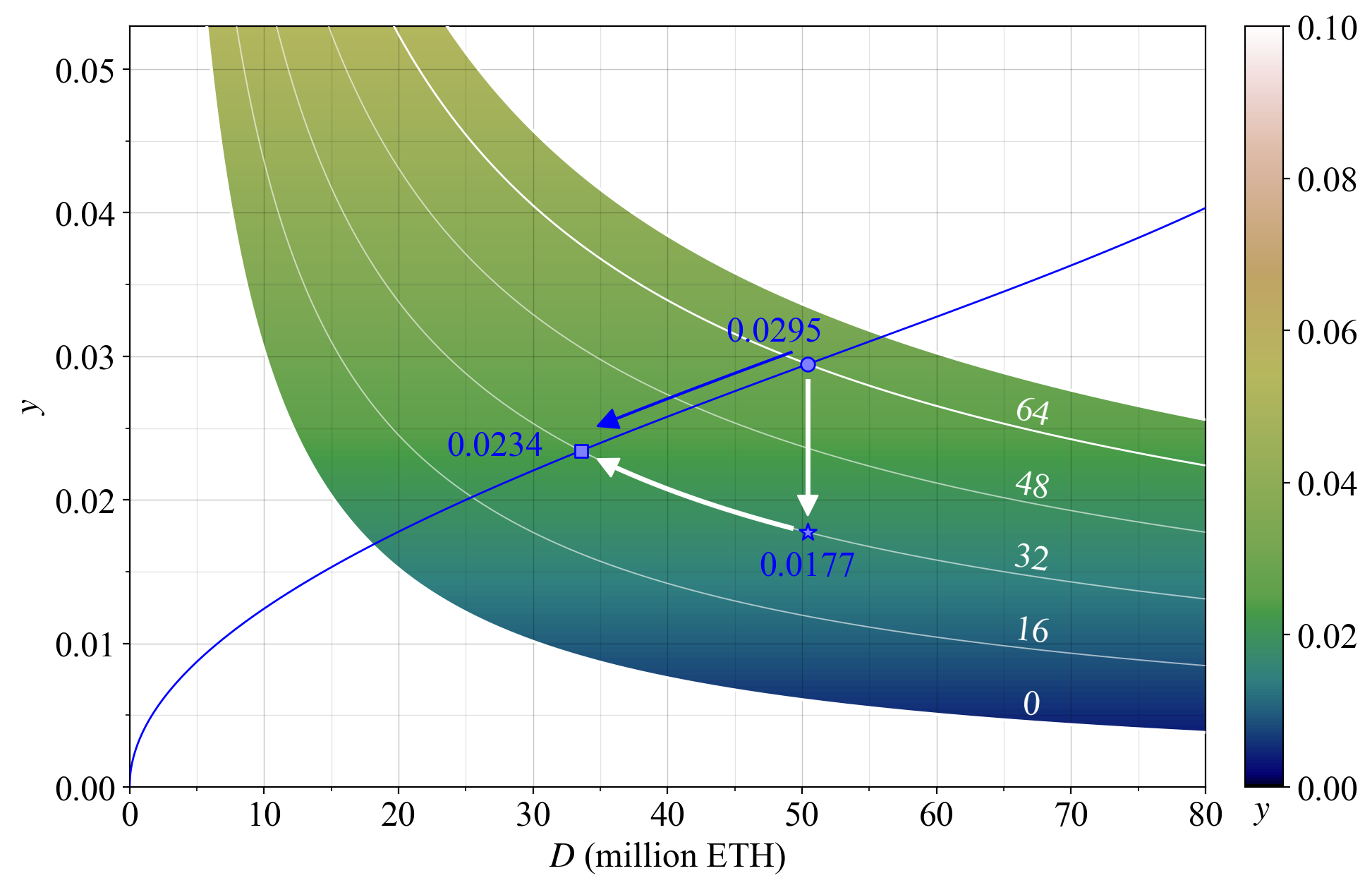

- MEV-Smoothing: Instead of awarding all proposer rewards from high-MEV blocks to a single validator, smoothing distributes earnings evenly across committee members in each slot. This not only curbs collusion but also levels income disparities among validators.

The Tangible Impact on User Experience and Ecosystem Health

The adoption of these redistribution mechanisms is already producing measurable improvements across several dimensions:

- User Protection: By refunding part or all of the extracted value back to traders and liquidity providers, these protocols reduce the net costs associated with slippage and manipulation.

- Equitable Value Sharing: When profits are distributed among all stakeholders, including LPs, traders, stakers, the ecosystem becomes more inclusive and sustainable over time.

- Transparency: Open sequencing rules and public auctions demystify transaction processing logic, building trust among both retail users and institutional participants.

This shift is not merely theoretical; empirical evidence from recent deployments shows improved outcomes for everyday traders who previously bore disproportionate losses due to hidden extraction practices.

Evolving Strategies for Sustainable MEV Markets

The move toward fairer MEV redistribution protocols signals an inflection point for DeFi market structure design. As AI-driven agents proliferate and stablecoin usage accelerates network activity, as noted by SKALE’s research, the stakes will only rise further. Addressing MEV extraction risks now is critical not just for protecting current users but also for ensuring long-term protocol resilience as volumes scale.

Protocols that prioritize MEV sharing strategies are paving the way for a more robust and equitable DeFi landscape. Notably, mechanisms like MEV-smoothing and transparent OFAs do more than just redistribute profits, they actively realign incentives for all participants. When liquidity providers, traders, and even validators know that value is returned to the ecosystem rather than siphoned off by a privileged few, their willingness to engage and provide resources increases. This self-reinforcing feedback loop attracts deeper liquidity, reduces volatility, and enhances overall market efficiency.

Recent data from live deployments of MEV Blocker and UniswapX highlight these improvements: users have reported lower effective trading costs, while validator income has become less erratic due to smoothing. The transparency provided by FSS implementations has also reduced the information asymmetry that previously allowed sophisticated searchers to dominate block space auctions. These advances are not just theoretical or limited to niche protocols, they are setting new standards for what users can expect from next-generation DeFi platforms.

Challenges and Trade-Offs in Implementing MEV Redistribution

Despite their promise, MEV redistribution protocols are not without trade-offs. Designing auctions or sequencing mechanisms that remain resistant to manipulation under high throughput conditions is a significant technical challenge. There is also an ongoing debate about the optimal balance between user privacy and transaction transparency, both critical for deterring predatory behavior but sometimes at odds with each other.

Another consideration is protocol composability: as DeFi becomes increasingly interconnected, changes in one platform’s MEV handling can ripple through others via cross-protocol arbitrage or liquidity migration. Protocol designers must therefore coordinate not only within their own ecosystems but also with adjacent protocols to ensure sustainable MEV markets on a broader scale. For those interested in practical implementation guidance, see our detailed guide on enhancing DeFi fairness through redistribution.

Key Trade-Offs in MEV Redistribution Protocol Design

-

1. User Protection vs. Protocol Complexity: Implementing robust MEV redistribution (e.g., via Order Flow Auctions in CoW Protocol or UniswapX) enhances user protection against front-running, but increases protocol complexity and maintenance overhead.

-

2. Fairness vs. Transaction Speed: Fair Sequencing Services (FSS), like Chainlink’s, ensure transparent transaction ordering, but may introduce latency compared to traditional sequencing, impacting high-frequency traders.

-

3. Maximizing User Rebates vs. Incentivizing Validators: Protocols like MEV Blocker refund up to 90% of builder rewards to users, but this can reduce direct incentives for validators, potentially affecting network security and participation.

-

4. Equalizing Validator Rewards vs. Encouraging Performance: MEV-smoothing (as seen in Ethereum research) distributes MEV earnings evenly among validators, promoting fairness, but may dampen incentives for validators to optimize block production.

-

5. Transparency vs. Privacy: Greater transparency in MEV redistribution (e.g., public OFA results) builds user trust, but can expose sensitive trading strategies, leading to new forms of exploitation.

What’s Next for Fairness in DeFi Trading?

The evolution of MEV redistribution is far from over. As new actors enter DeFi, ranging from AI trading agents to institutional liquidity providers, the pressure will mount for protocols to adopt more adaptive, transparent, and community-aligned approaches. Expect further innovation around dynamic auctions, cryptographic privacy solutions for order flow, and cross-chain coordination frameworks.

Ultimately, the trajectory is clear: sustainable MEV markets depend on mechanisms that reward participation fairly while deterring exploitative behaviors. By embracing these principles now, protocol designers and users alike can help shape a future where DeFi trading fairness is not an aspiration but a baseline expectation.

For further reading on strategies and tools powering this shift toward equity in decentralized finance, explore our resources on MEV redistribution strategies.