Liquidity providers (LPs) are the lifeblood of decentralized exchanges (DEXs), yet for years, they’ve faced an uphill battle against invisible losses caused by Maximal Extractable Value (MEV). In today’s DeFi landscape, MEV-aware DEX protocols are stepping up to shield LPs from these hidden drains, especially from Loss Versus Rebalancing (LVR), where arbitrageurs profit by rebalancing pools at LPs’ expense. Let’s explore how these next-generation protocols are reshaping incentives and redistributing MEV to protect and reward those who provide liquidity.

What is LVR? The Subtle Threat Facing LPs

LVR, or Loss Versus Rebalancing, is a particularly insidious form of MEV loss. Here’s how it works: when prices move on external markets, arbitrageurs rush in to realign DEX pool prices. They profit from the price discrepancy, but the cost is borne by LPs whose assets get rebalanced at less favorable rates. This silent leakage has made many question if providing liquidity is worth the risk, until now.

MEV-aware DEX protocols are designed with this challenge front and center. By capturing and redistributing MEV that would otherwise be siphoned off by sophisticated bots or searchers, these platforms ensure that value flows back to LPs instead of being extracted away.

How Modern Protocols Redistribute MEV and Mitigate LVR

Several innovative protocols have emerged with unique approaches to MEV redistribution strategies. Let’s break down some of the leading designs making waves in late 2025:

- RediSwap: This AMM captures MEV at the application level, meaning it intercepts arbitrage profits before external actors can claim them, and then fairly refunds this value among both users and LPs. By internalizing arbitrage opportunities, RediSwap minimizes LVR and offers a more equitable trading environment.

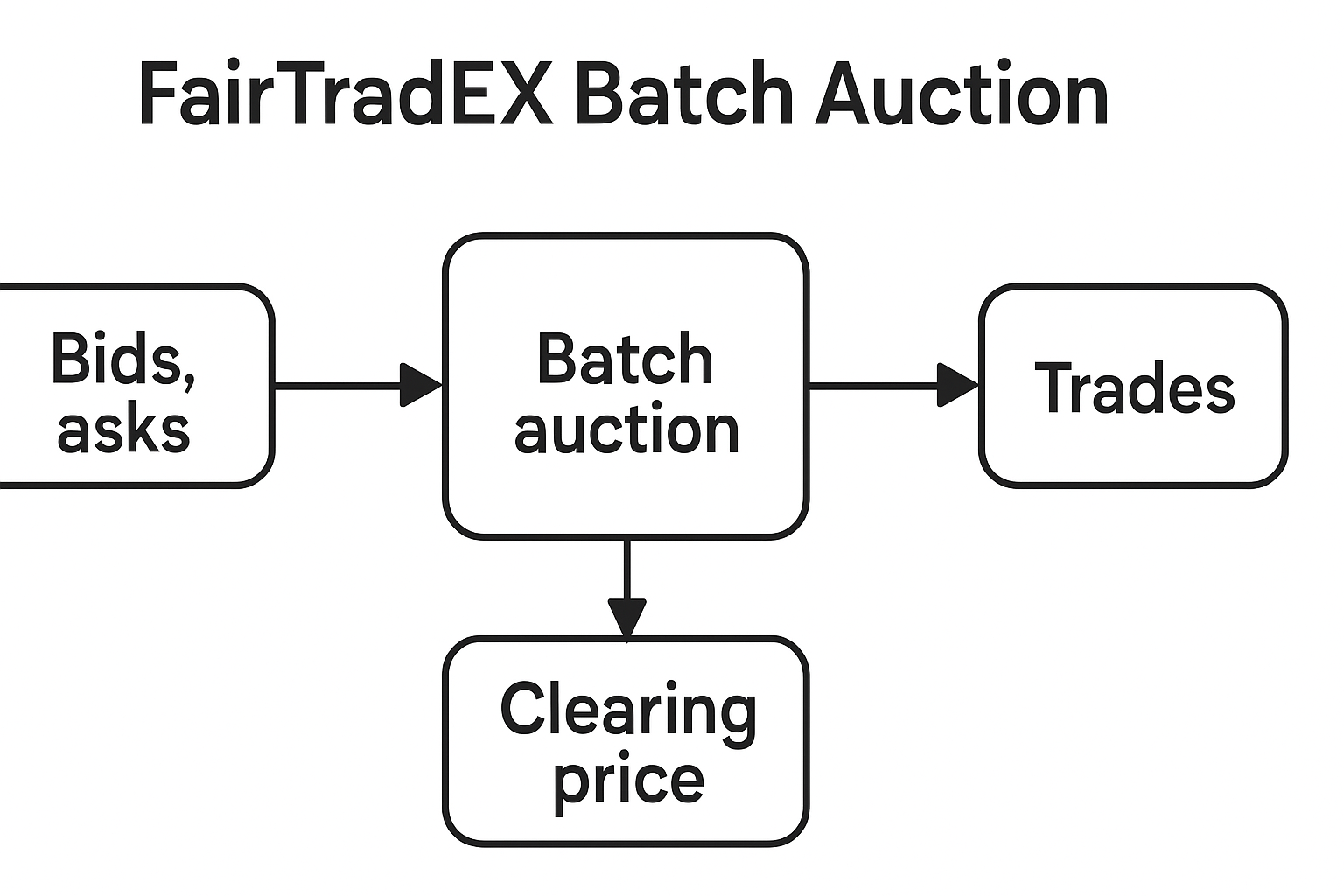

- CoW Protocol: CoW Swap leverages batch auctions and solver competition to prevent predatory MEV attacks. The protocol’s latest AMM extension introduces an internal MEV capture system: solvers bid for the right to rebalance pools, and the resulting surplus is returned directly to LPs as a new revenue stream.

- FairTraDEX: By using frequent batch auctions (FBAs) combined with zero-knowledge proofs and commit-reveal schemes, FairTraDEX provides robust guarantees against extractable value. Its fixed fee model ensures that fees do not scale with order size or timing advantages, a direct blow against LVR exploitation.

- V0LVER: Built atop an encrypted mempool, V0LVER only decrypts trades after liquidity has been assigned. This clever design aligns block producers’ incentives with honest pricing while preventing both frontrunning and uncontrolled LVR losses for users and LPs alike.

The Real-World Impact: Boosting LP Confidence and Yields

The adoption of these mechanisms is already shifting market dynamics. With Uniswap (UNI) currently priced at $6.04, we’re seeing renewed confidence among liquidity providers as their potential yields become more resilient against stealthy forms of value extraction. By returning a share of captured MEV back to those who supply capital, protocols foster deeper liquidity pools, a win-win for traders seeking low slippage and for LPs pursuing sustainable returns.

If you’re interested in a deeper dive into how redistribution engines reward liquidity providers on DEXes, check out our comprehensive guide here.

The Rise of Dynamic Fees and Auctions: Taxing Arbitrageurs for Fairness

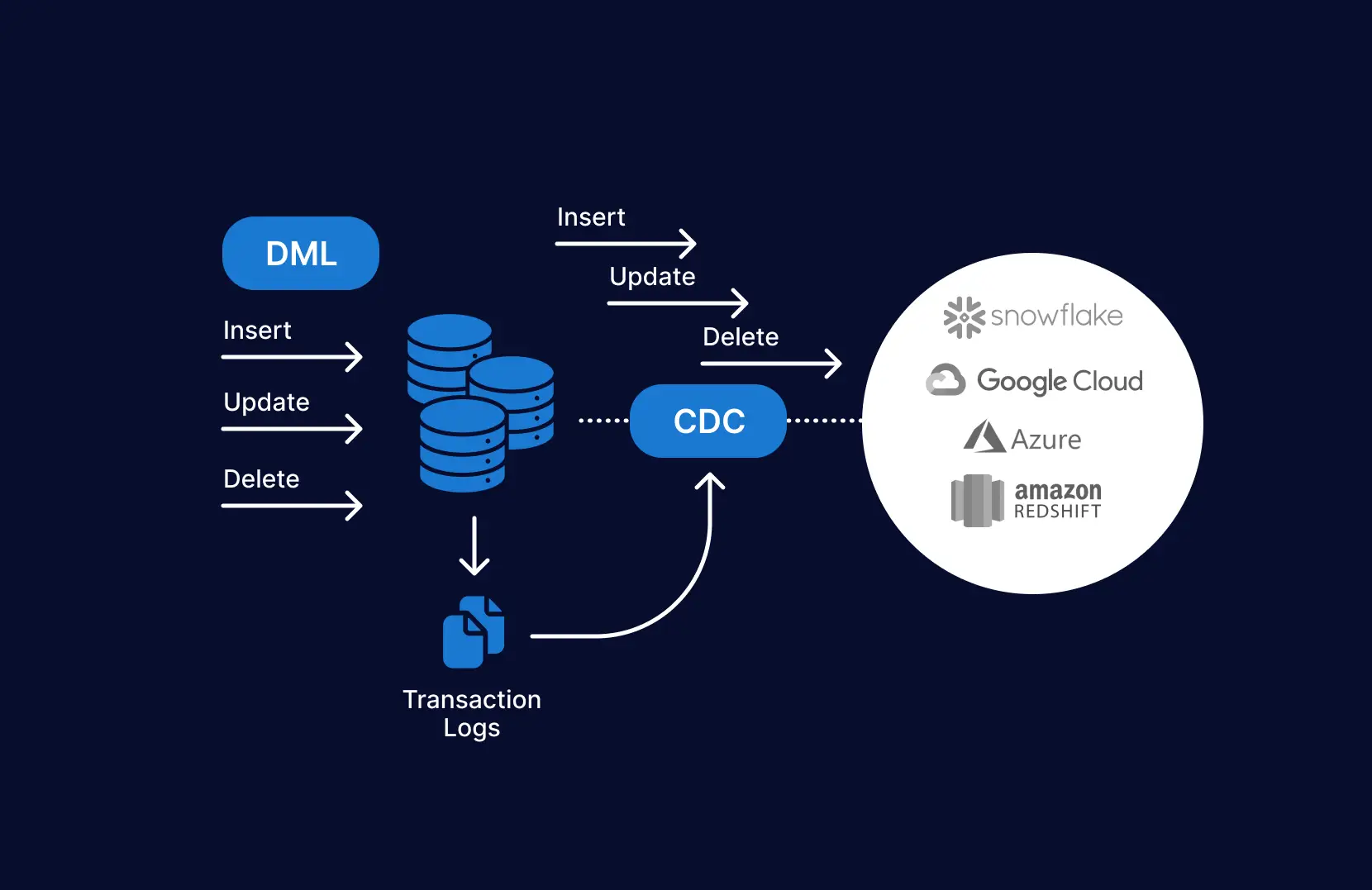

A key innovation underpinning this shift is the use of dynamic fees and on-chain auctions. Instead of letting arbitrageurs pocket all the profits from price misalignments, protocols like Arrakis Finance use dynamic fee models that “tax” informed traders based on market volatility or imbalance severity. This means that when markets are turbulent, precisely when LVR risk spikes, fees automatically rise to capture more value for redistribution among LPs.

This approach does more than just recapture value, it also discourages opportunistic MEV extraction that would otherwise erode LP returns. In effect, sophisticated actors are now incentivized to participate in a way that benefits the protocol’s health rather than undermining it. Through on-chain MEV auctions, DEXs can transparently allocate rebalancing rights to the highest bidder, ensuring that any surplus generated is fed back into the ecosystem.

Protocols like Wallchain and RediSwap go a step further by integrating MEV rebate mechanisms directly into their platforms. These systems function almost like a “cashback” program for liquidity providers, every time an arbitrageur profits from a pool, a portion of those gains is automatically redistributed to LPs. This not only levels the playing field but also introduces new DeFi LP incentives that were previously unavailable in traditional AMMs.

What to Watch: MEV-Aware DEXes Set New Standards for LP Protection

The rise of MEV-aware DEX protocols signals a paradigm shift in how decentralized markets operate. No longer do liquidity providers have to accept LVR losses as an unavoidable cost of participation. Instead, they can now expect more predictable and competitive returns, especially as more protocols adopt MEV redistribution strategies and dynamic fee structures.

Top MEV-Aware DEX Protocols Protecting LPs from LVR

-

RediSwap: This innovative AMM captures MEV at the application level and redistributes profits fairly among users and LPs. By managing arbitrage internally, RediSwap minimizes LVR and ensures liquidity providers receive a share of value that would otherwise be lost.

-

CoW Protocol (CoW Swap & CoW AMM): Leveraging batch auctions and solver competition, CoW Protocol protects traders and LPs from MEV attacks. Its AMM design rebates MEV profits back to LPs, turning what was once a loss into a new income stream.

-

FairTraDEX: Utilizing frequent batch auctions (FBAs) and zero-knowledge protocols, FairTraDEX guarantees LP protection from extractable value. Its fixed fee model and commit-reveal schemes help maintain fair trading and minimize LVR.

-

V0LVER: Built on an encrypted mempool, V0LVER only decrypts transactions after liquidity is allocated, preventing MEV extraction and uncontrolled LVR. This design incentivizes fair pricing and protects both users and LPs from predatory arbitrage.

As the landscape evolves, we’re seeing new standards emerge for what constitutes fair and efficient DeFi infrastructure. Protocol designers are increasingly prioritizing transparency, user empowerment, and equitable value sharing, core tenets that will define the next generation of decentralized finance.

If you’re an LP or protocol developer, staying informed about these innovations is crucial. The future of sustainable DeFi hinges on robust mechanisms for liquidity provider protection against LVR losses and other forms of hidden MEV extraction. By embracing these advances, you not only safeguard your capital but also contribute to building a healthier ecosystem for everyone involved.