Every time you interact with a decentralized finance (DeFi) protocol, you may be unknowingly leaving value on the table. This value, known as Maximal Extractable Value (MEV), has traditionally been captured by miners or validators through transaction reordering and prioritization. But the DeFi landscape is changing rapidly: innovative MEV rebate mechanisms are shifting the balance, putting users back at the center of value creation and distribution.

MEV: The Hidden Cost in Every DeFi Transaction

MEV is the profit that block producers can extract by managing transaction ordering within blocks. On platforms like Ethereum, where the current price sits at $4,084.24, these profits can be substantial. MEV manifests in forms like front-running or sandwich attacks, where users end up paying higher fees or receiving worse execution on their trades. The cumulative impact is a drain on user yield and trust, as well as an ongoing challenge for protocol fairness.

Recent research and market data reveal that users lose significant value to MEV daily. As highlighted in the latest analyses, this extraction undermines confidence in DeFi protocols and can destabilize liquidity pools. The need for transparent MEV markets and user-aligned incentives has never been more urgent.

Innovative MEV Redistribution: From Extraction to User Rebates

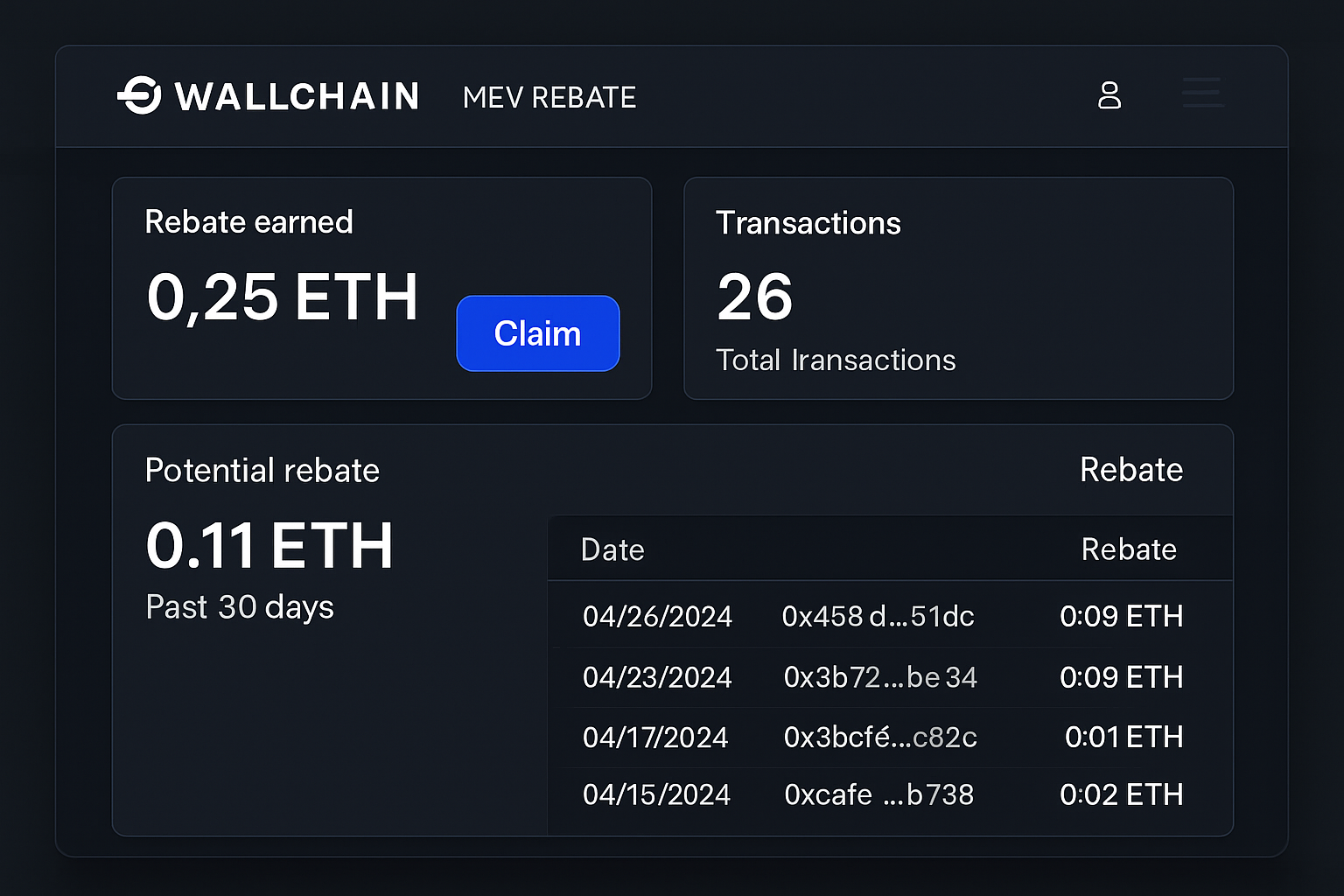

Enter MEV rebates: a new generation of protocols is emerging to capture MEV at the application or protocol layer, then redistribute it directly to users. Wallchain integrates with DeFi platforms to capture arbitrage profits, combining user swaps with searcher strategies. Instead of letting these profits flow to miners or external searchers, Wallchain shares them back with users in real time. This model is gaining momentum, with daily on-chain activity now feeding transparent, verifiable rebate streams.

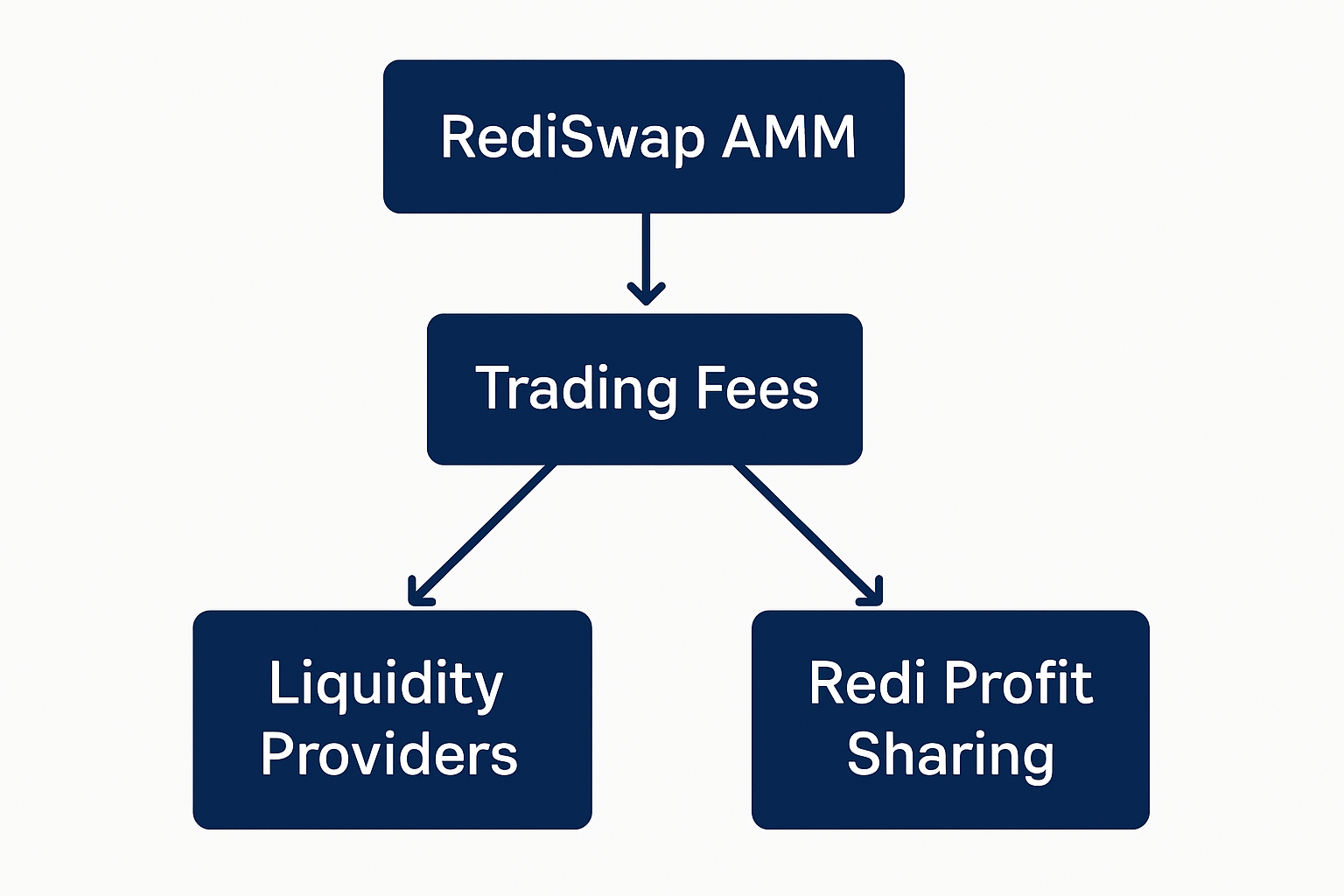

Another breakthrough comes from RediSwap, which is designed to capture MEV at the automated market maker (AMM) level. RediSwap refunds extracted MEV fairly among both traders and liquidity providers, transforming what was once a hidden tax into a source of DeFi user yield. Meanwhile, solutions like MEV Blocker refund up to 90% of builder rewards to the users who trigger valuable signals, turbocharging user engagement and protocol alignment.

User-Centric Value Redistribution: The New DeFi Norm

The shift toward user-centric MEV redistribution is not limited to Ethereum. On Solana, Jito DAO’s proposal to allocate 3% of all MEV tips to its treasury and TipRouter program is projected to generate $22.8 million annually for the DAO. Chainlink’s Smart Value Recapture (SVR) enables DeFi applications to recapture non-toxic MEV through their own oracle infrastructure, reducing reliance on intermediaries and making MEV sharing accessible to all Price Feed users.

ZENMEV’s asset protection suite exemplifies another major trend: users can stake assets to share in redistributed MEV profits, flipping the narrative from loss to gain. These mechanisms are not just technical upgrades; they are fundamental shifts in how DeFi protocols define fairness, user rewards, and sustainable growth.

Ethereum (ETH) Price Prediction 2026-2031

Forecast based on emerging MEV rebate mechanisms, DeFi adoption, and evolving market dynamics

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change from 2025 Avg. |

|---|---|---|---|---|

| 2026 | $3,800 | $4,400 | $5,300 | +6% |

| 2027 | $4,100 | $5,050 | $6,200 | +23% |

| 2028 | $4,550 | $5,800 | $7,400 | +42% |

| 2029 | $4,900 | $6,750 | $8,900 | +65% |

| 2030 | $5,400 | $7,500 | $10,300 | +84% |

| 2031 | $6,100 | $8,600 | $12,000 | +111% |

Price Prediction Summary

Ethereum is poised for steady growth through 2031 as user-centric MEV rebate mechanisms and DeFi innovation drive increased network participation and transaction volume. While short-term volatility remains possible due to regulatory and macroeconomic factors, ETH’s value proposition as a foundational DeFi asset is strengthened by improved fairness, user trust, and sustainable protocol revenues. Bullish scenarios project significant price appreciation if Ethereum continues to dominate DeFi and successfully implements scalability upgrades, whereas bearish scenarios reflect potential global regulatory headwinds and competition from alternative Layer 1 blockchains.

Key Factors Affecting Ethereum Price

- Adoption and effectiveness of MEV rebate and redistribution protocols, enhancing user trust and network activity.

- Ongoing improvements to Ethereum scalability (e.g., sharding, rollups) and Layer 2 adoption.

- Regulatory developments in key markets affecting DeFi and staking.

- Macro market cycles, including Bitcoin halving events and general risk appetite.

- Competitive pressure from other smart contract platforms (e.g., Solana, Avalanche, Sui).

- Institutional adoption and integration of Ethereum-based financial products.

- Potential black swan events or security incidents affecting DeFi protocols.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Transparent MEV Markets: Aligning Incentives for the Future

As MEV rebates become standard, the DeFi ecosystem is moving toward greater transparency and efficiency. Projects like MorphLayer are building secure, auto-audited environments where every transaction is optimized for both security and user yield. These developments are paving the way for transparent MEV markets, where ordering surplus redistribution is not just possible but expected.

For protocol designers, traders, and DeFi enthusiasts, understanding and leveraging these new MEV redistribution strategies is key to staying ahead. The rise of user-aligned incentives is fundamentally changing the game, rewarding participation, enhancing fairness, and supporting sustainable protocol economics. For a deeper dive into how these trends are transforming user rewards across DeFi mechanisms, see this expanded analysis.

While the technical evolution of MEV rebates is impressive, the true impact lies in the tangible benefits for everyday users. By reclaiming value that was once siphoned off by miners or searchers, users are now active stakeholders in the protocols they engage with. This not only boosts direct DeFi user yield, but also helps cultivate a more loyal, participatory community, one that is incentivized to contribute to the protocol’s health and long-term vision.

Consider the impact on trading behaviors: previously, users had to factor in the hidden cost of MEV extraction when swapping assets, particularly on high-value chains like Ethereum, where the current price stands at $4,084.24. Now, with MEV redistribution mechanisms like Wallchain and RediSwap, users can expect a portion of those extracted profits to flow back into their wallets. This shift is already altering how users select trading venues, with MEV-sharing platforms seeing increased volume and liquidity as a result.

Key Features of Modern MEV Redistribution Mechanisms

Top 5 Features of User-Centric MEV Redistribution Protocols

-

Direct Rebates to Users: Protocols like Wallchain and MEV Blocker return a significant portion of captured MEV profits directly to users, often as high as 90% of builder rewards. This ensures users benefit from on-chain activity that would otherwise be exploited by miners or validators.

-

On-Chain Transparency and Auditability: User-centric protocols provide real-time, verifiable data streams for all MEV-related transactions, as seen in Wallchain’s multi-chain integration. This transparency builds trust and allows users to independently verify rebate distributions.

-

Seamless Integration with DeFi Platforms: Leading protocols like Wallchain and Chainlink SVR are designed for easy integration with existing DeFi applications, enabling platforms to capture and redistribute MEV without disrupting user experience or requiring complex migrations.

-

User Protection and Asset Security: Protocols such as ZENMEV emphasize asset protection by employing staking systems and smart contract audits, ensuring that users not only receive MEV rebates but also benefit from enhanced security and minimized risk of exploitation.

Transparency is another cornerstone of this new era. Platforms like MorphLayer and Wallchain are leveraging real-time, verifiable data streams to ensure users can see exactly how much value is being extracted and redistributed. This level of openness not only builds trust but also allows users and developers to audit MEV flows, reducing the risk of hidden extraction or opaque fee structures.

Security is equally paramount. With the proliferation of auto-audited smart contracts and robust infrastructure, users can interact with DeFi protocols knowing that their transactions are protected from malicious MEV strategies. This is especially critical in a market where even a small vulnerability can lead to substantial losses.

Looking ahead, the continued adoption of MEV rebates and transparent value sharing is set to redefine DeFi’s competitive landscape. Protocols that prioritize user-aligned incentives and fair ordering surplus redistribution will attract more liquidity, foster greater innovation, and set new standards for protocol governance. As the market matures, we can expect further integration of MEV-sharing logic into core DeFi primitives, blurring the line between protocol infrastructure and user-facing rewards.

For those building or trading in DeFi, it’s time to revisit assumptions about where value accrues. The days of passive value loss to MEV are numbered. By embracing transparent MEV markets and leveraging solutions like Wallchain, RediSwap, and MorphLayer, participants can actively shape a more equitable and efficient financial future. For additional strategies and technical deep-dives, explore our companion guide on transforming DeFi user incentives and protocol fairness.